last day to pay mississippi state taxes

Mass Mailing of Income Forms Discontinued. 0 on the first 2000 of taxable income.

Yes California Has The Highest Tax Revenue California Has Some Of He Highest Taxes But It Also Has The Family Money Saving Business Tax Economy Infographic

To make payments without a penalty.

. How do I report Gambling Winnings. The taxable wage base in 2022 is 14000 for each employee. 5 on all taxable income over 10000.

The exact property tax levied depends on the county in Mississippi the property is located in. If you miss it youll be charged an interest rate of 2 per month. The due date is April 182022.

3 on the next 3000 of taxable income. Tate Reeves on Tuesday signed a bill that. To make an online payment visit your county official website for further instructions.

Ad No Money To Pay IRS Back Tax. You can use this service to quickly and securely pay your Mississippi taxes using a credit card debit card or eCheck. Where do I mail my return.

February 1 st - Deadline for paying property taxes without accruing interest. People who owe money on their 2021 property and land taxes have until Monday Feb. Mississippi state taxes are due annually on April 15 Mississippi collects a state income tax at a maximum marginal tax rate of spread across tax brackets.

Mississippi State Unemployment Insurance SUI As an employer youre responsible for paying SUI remember if you pay your state unemployment tax in full and on time you get a 90 tax credit on FUTA. 1 is last day to pay land taxes without penalty. Mississippis SUI rates range from 0 to 54.

If you miss it youll be charged an interest rate of 2 per month. Mississippi Income Tax Calculator 2021. With one or more employees for any portion of one day a week in each of 20 different weeks in a calendar year and described the conditions which must be met by the state law to entitle the employers in that state to a credit against this tax.

Like the Federal Income Tax Mississippis income tax allows couples filing jointly to pay a lower overall rate on their combined income with wider tax brackets for joint filers. Once the roll is approved the Tax Collector sends out notices and owner have the following dates to keep in mind. Check the Status of your Individual Inco me Tax Refund What is the due date.

Mississippi income tax rate. 31 2021 can be e-Filed together with the IRS Income Tax Return by the April 18 2022 due date. The 2021 Mississippi State Income Tax Return forms for Tax Year 2021 Jan.

February 2 nd - Interest will begin to accrue at 05 12 per month. The tax rates are as follows. If you make 70000 a year living in the region of Mississippi USA you will be taxed 11472.

Why did you send me a 1099-G. The due date for filing a MS tax return and submitting MS payments is April 18 2022. The last day to pay property taxes is December 31.

The Mississippi state tax rate is graduated and are the same for individual filers as well as businesses. AP Mississippi residents will pay lower income taxes in coming years as the state enacts its largest-ever tax cut. Effective July 1 2011 Federal Unemployment Tax is levied at 60.

Madison County collects the highest property tax in Mississippi levying an average of 120400 066 of median home value yearly in property taxes while Amite County has the lowest property tax in the state collecting an average tax of 28100. Apt Suite etc City. 1 at 5 pm.

Your average tax rate is. Find IRS or Federal Tax Return deadline details. The credit amount is 54.

4 on the next 5000 of taxable income. Review You must. Why didnt you mail me an income tax form.

But since Mississippi does not require retirees to pay state income tax on qualified income the money in your 401k is never subject to state-level taxes if you retire in the state.

How Do State And Local Sales Taxes Work Tax Policy Center

States With Highest And Lowest Sales Tax Rates

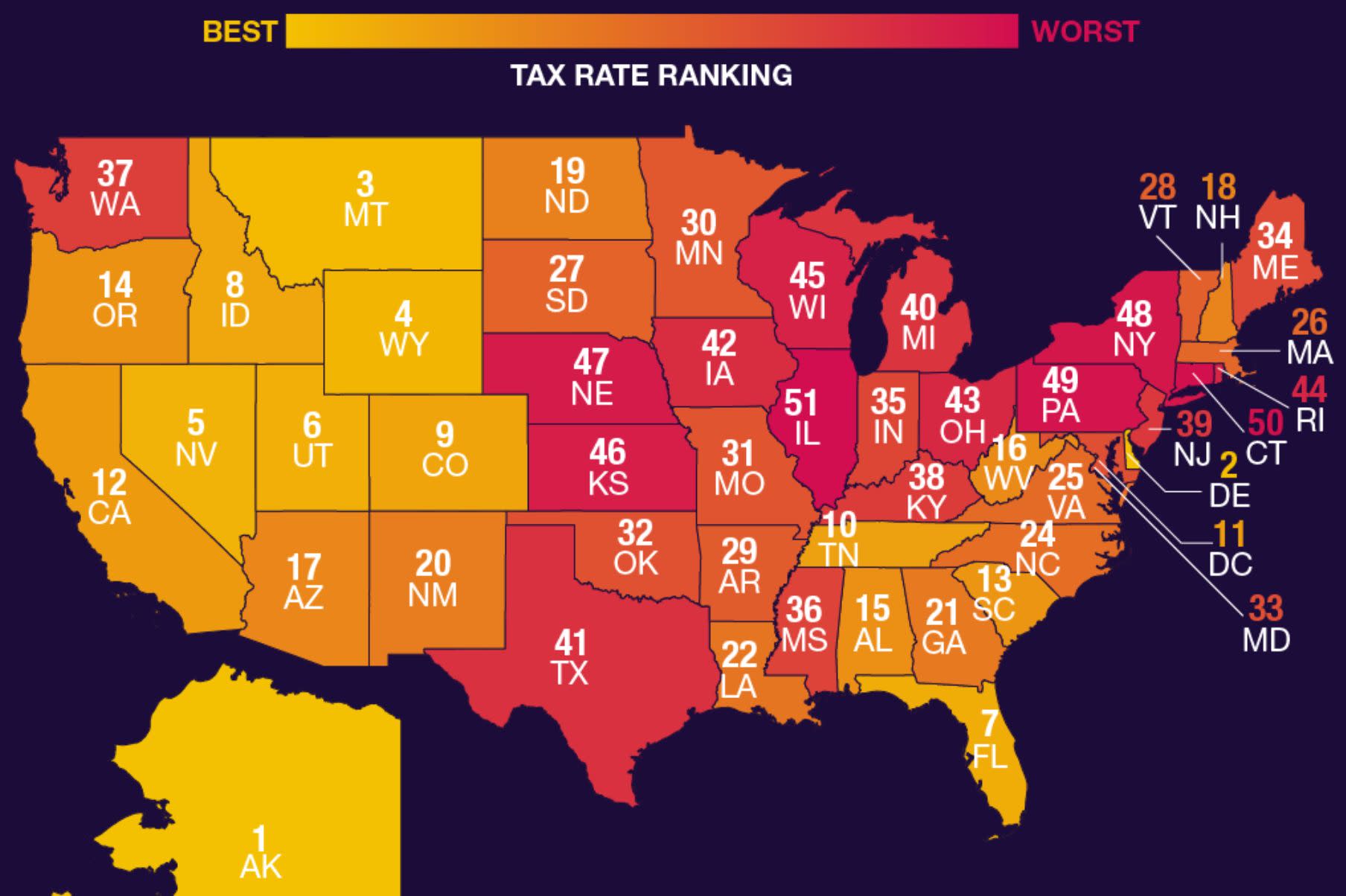

The Best And Worst U S States For Taxpayers

Map The Most And Least Tax Friendly States Yahoo Finance Best Places To Retire Map Life Map

The Kiplinger Tax Map Guide To State Income Taxes State Sales Taxes Gas Taxes Sin Taxes Gas Tax Healthcare Costs Better Healthcare

Everyone Who Pays Taxes Should Ask This Question Why Am I Paying Taxes On My Wages Then Paying Sales Taxes To Spend My Money Then Paying Income Taxes On Money They Already

Your Tax Bill 107 Days Of Work To Pay Off Interesting Information Freedom Day Thoughts

Tax Friendly States For Retirees Best Places To Pay The Least

State Corporate Income Tax Rates And Brackets Tax Foundation

Last Week We Published A Map Showing How Far 100 Would Take You In Different States For Example In States With Low Costs Of Li Map Economic Map What Is 100

Tax Burden By State 2022 State And Local Taxes Tax Foundation

Mississippi State Tax Refund Ms State Tax Brackets Taxact Blog

Most State Taxes Due April 17 Too

How Do State And Local Individual Income Taxes Work Tax Policy Center

Top Income Tax Rate By State States With No Income Tax 1 Alaska 2 Florida 3 Nevada 4 South Dakota 5 Retirement Income Retirement Best Places To Retire

Tax Friendly States For Retirees Best Places To Pay The Least

State Corporate Income Tax Rates And Brackets Tax Foundation

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation