franklin county ohio sales tax on cars

Web The fees go to the Ohio Department of Motor Vehicles DMV. The 2018 United States Supreme Court decision in South Dakota v.

1 Critical After Crash In Southeast Franklin County 10tv Com

A Title Fee 15.

. This table shows the total sales tax rates for all. Franklin Countys is 75. In Montgomery County property taxes are due on Feb.

Web Motor Vehicle Overview - Franklin County Clerk of Courts Menu Title Classifications and Fees Original Title Title issued to a new owner for the very first time and most commonly. Web Franklin County Ohio Sales Tax On Cars. Web Ohio collects a 575 state sales tax rate on the purchase of all vehicles.

The Franklin County sales tax rate is. The 2018 United States. You may obtain county sales tax rates through.

Web Auto repairs are regulated by Ohios Auto Repairs and Services Law. Web Listing of upcoming properties for sale. Three Ohio Senate races to watch in Franklin County.

15 and July 19 each year. Web What is the sales tax on cars in Franklin County Ohio. Some dealerships may also charge a 199 dollar.

The City of Rossford in Wood County assesses transit rate of 050 in addition to the posted state and. Web Franklin County OH Sales Tax Rate The current total local sales tax rate in Franklin County OH is 7500. Web The Ohio state sales tax rate is currently.

The Franklin County Treasurers Office wants to make sure you are receiving all reductions savings and assistance to which you may be entitled. May 11 2020 TAX. Web Ohio Revised Code sections 572130 to 572143 permit the Franklin County Treasurer to collect delinquent real property taxes by selling tax lien certificates in.

The Ohio sales tax rate is currently. This is the total of state county and city sales tax rates. As of January 1 2020 the sales tax rate for Franklin County Ohio is 725.

With the midterms about a week away election season is reaching its apex. Your tax rate depends on your county of residence. Web For example property taxes in Franklin County are due on Jan.

Web The current sales tax on car sales in Ohio is 575. Web The Franklin County Sales Tax is 125. If you have questions contact the Ohio Attorney Generals Office at 800 282-0515 or 614 466-4320.

Web Franklin county ohio sales tax on cars. Web Election 2022. Web Ohio collects a 575 state sales tax rate on the purchase of all vehicles.

The leaves are falling. There are also county taxes that can be as high as 2. Web The combined sales tax rate for Franklin County OH is 75.

6 rows The Franklin County Ohio sales tax is 750 consisting of 575 Ohio state sales. Web The minimum combined 2022 sales tax rate for Franklin Ohio is. This rate is made up of a 675 state sales tax.

You may obtain county sales tax rates through the Ohio Department of Taxation. The county sales tax rate is. A county-wide sales tax rate of 125 is applicable to localities in Franklin County in addition to the 575 Ohio sales tax.

Web Sales tax is required to be paid when you purchase a motor vehicle or watercraft. In addition to franklin county a 05 percent sales tax funding. The December 2020 total local sales tax rate was also 7500.

20 and June 20 each year. Its important to note this does not include any local or county sales tax which can go up to 225 for a total sales tax rate. Here are the fees you need to account for before you agree to buy a vehicle in Ohio.

Ohio Tax Rates Things To Know Credit Karma

Used Cars For Sale In Franklin Tn Cars Com

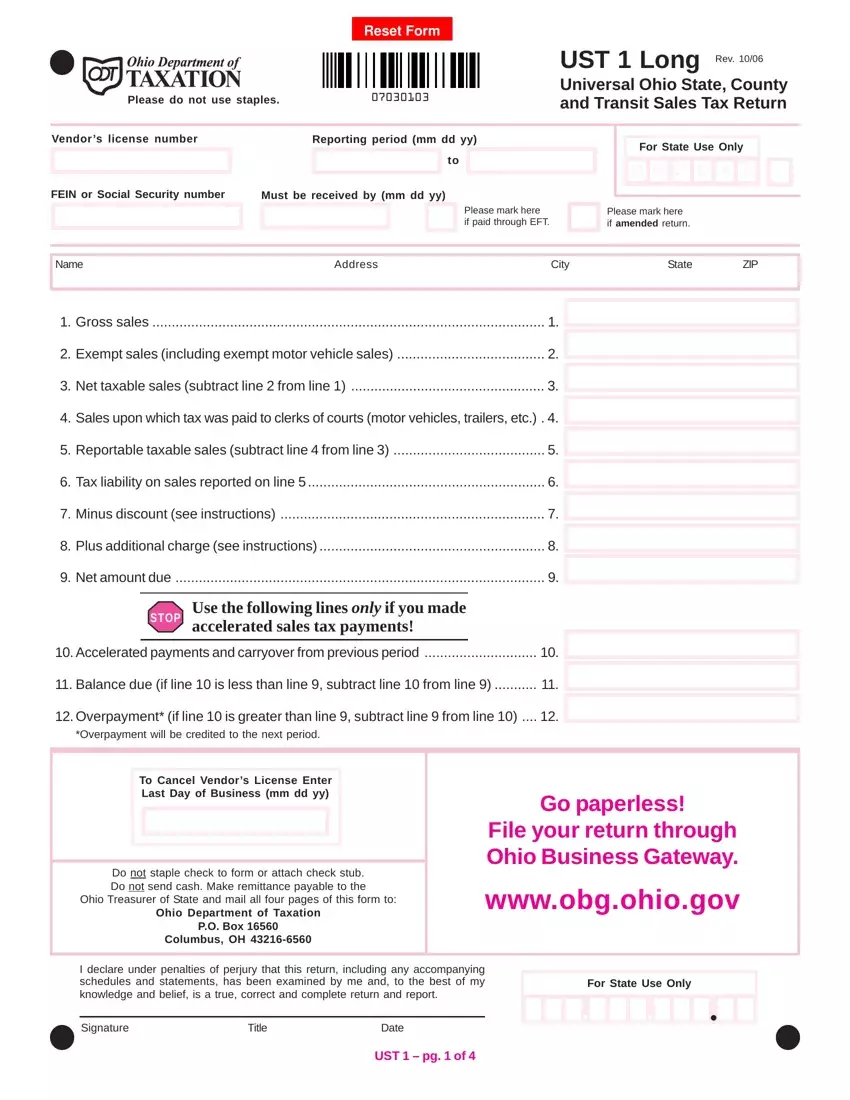

Ohio Sales Tax Ust 1 Fill Out Printable Pdf Forms Online

Vehicle Importing Overview Franklin County Clerk Of Courts

9 Graphical Things To Know About Gov Kasich S Ohio Budget Proposal Cleveland Com

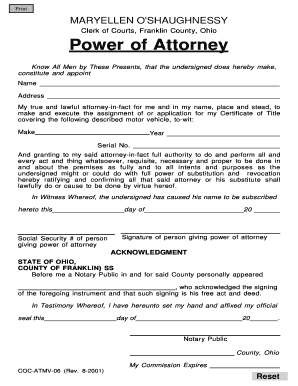

Bill Of Sale Form Ohio Power Of Attorney For Vehicle Registration Form Templates Fillable Printable Samples For Pdf Word Pdffiller

How Healthy Is Franklin County Ohio Us News Healthiest Communities

Pennsylvania 2022 Sales Tax Calculator Rate Lookup Tool Avalara

Is It Required By Law To Get Your Car Inspected Car Inspection Laws Guide

Two Dead One Critical After Three Vehicle Crash In Canal Winchester Nbc4 Wcmh Tv

Ohio Vehicle Sales Tax Fees Calculator Find The Best Car Price

Franklin County Ohio Businesses For Sale Buy Franklin County Ohio Businesses At Bizquest

Ohio Lawmakers Want Cng Electric Car Purchases To Get Tax Breaks To Support Alternative Fuels Columbus Business First

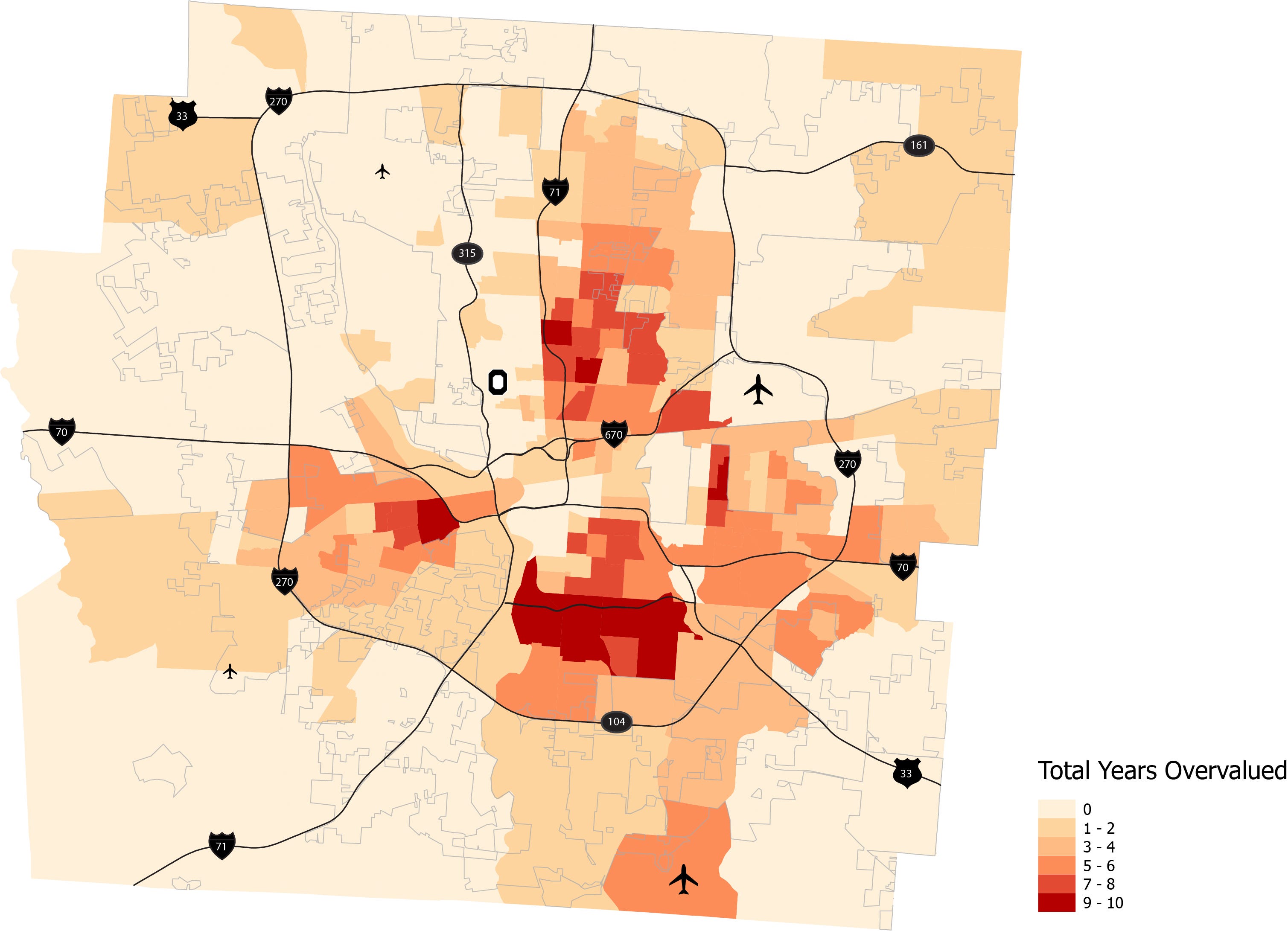

Franklin County Real Estate Taxes Overvalued Poor Black Neighborhoods

Ohio S Highest Local Property Tax Rates Some Homeowners Pay Four Times The Rate Of Others Cleveland Com

18 Pre Owned Cars For Sale In Columbus Mercedes Benz Of Easton